Appriz app for iPhone and iPad

Appriz is a mobile app solution that enables interactive, cost effective communication between a customer and his financial services company.

Appriz integrates multiple financial products and transactions across services such as credit and debit cards, checking, savings, insurance, loans, and investments. It also bridges all the channels that customers use such as mobile devices, ATMs, electronic banking, IVR (interactive voice response), point of sales, and others.

Appriz is composed of five main functionalities:

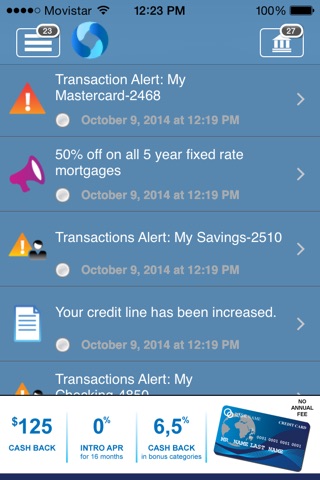

My Alerts

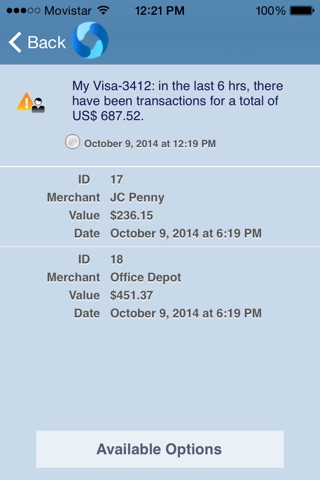

My Alerts enable customers to control their own real-time transaction information. Unlike traditional alerts, all account activity is monitored and reported as it is happening across multiple transactions.

Customers define their own, custom alert parameters by using a simple Appriz interface. Whenever the rules are broken or there is unusual transaction activity for that specific customer’s account - even across multiple products, channels, and transactions – an alert will be sent to the customer.

Each alert displays the set of conditions that were violated and details regarding the transaction(s) involved. Based on the alert and associated rules, Appriz then directs the customer to take a specific, immediate action such as blocking the account, blocking ATM withdrawals, or contacting customer service at the institution.

Fraud Warnings

Appriz Fraud Warnings are a immediate means to resolve potential fraudulent activity. When unusual transactional activity is detected by the institution’s internal monitoring and fraud prevention system, Appriz will instantly send an alert to the customer’s smartphone with the transaction(s) in question.

Right from the Appriz mobile app, the customer can take immediate action such as blocking the account, blocking ATM withdrawals, blocking payments and transfers, and/or speaking with a customer service representative.

Notifications

Help strengthen the customer relationships and improve customer service by enabling the institution to interact with customers on issues specific to their individual interests. Depending on the type of notification, the financial institution can also request a response or action from the customer using Appriz. This speeds the institution’s ability to offer, respond and act on customer needs.